Though Google is with us for a long time already and we have many advanced neural networks that can answer any questions, there are still people who know nothing about finance, live in debt, or from salary to salary. Needless to say, the constant stress about your financial situation makes life miserable.

In this article, I will give you a complete guide on personal finance so you can be more confident in your financial situation. What I share with you here is what I do myself already for 10+ years and teach my friends and relatives to do the same.

1. Track your expenses

Start by writing down your expenses by category, you should know how much are you spending and on what. Do it at least for 3 months, but better make it a regular habit of yours. The goal here is to see your expenses and spend less than you earn!

Why?

- You will be able to see what takes the most money out of your pocket in order to decrease this expense.

- By knowing your expenses you can easily understand whether you are spending above your income.

- Monthly expenses will be used to calculate the emergency fund (wait for it).

How?

- Look for mobile apps where you can track your expenses. If your bank is able to do a detailed overview of expenses by categories it’s already good enough. I myself use CoinKeeper(not an ad).

- If you don’t like any app, make an Excel where you track each expense and group them by food, transport, shopping, house, leisure, medicine, sport, education, gifts, etc.

2. Revise your expenses

Take a critical look at your expenses and identify where you spend the most money. Consider ways in which you can reduce these expenses.

Why?

- The ultimate rule is that you must spend less than you earn!

How?

- Get rid of subscriptions you don’t use.

- Order less food from restaurants and cook more at home.

- Don’t buy needless expensive items. Instead of an Apple napkin buy any other, or don’t buy at all.

- Use public transport instead of a car.

- If the situation is tough, consider moving to a cheaper apartment.

- Use unlimited mobile internet and a hotspot feature, instead of paying for both home internet and mobile service.

- Overall, try to reduce all expenses except for essentials in order to live within your budget.

3. Plan your expenses

Whether you like it or not, sometimes you have to make expenses. You may need to fix your car, go to the dentist, or buy an educational course. Your phone or laptop might break and need to be replaced, and traveling can be costly. To avoid exceeding your budget, it’s important to plan for big expenses ahead of time and have funds available for them.

Why?

- Planning your upcoming expenses will help you understand how much money you currently have available for the purchase and how much additional money is needed.

- Sticking to your budget for each category of expense ensures that you stay within your overall budget and do not overspend, leaving funds available for other expenses.

- By listing essential expenses and planning for upcoming big expenditures, you can determine how much money you have available for leisure activities on a daily basis.

How?

- Make a sheet or use this template (make a copy to use it)

- Put your monthly salary. You will use it to calculate how much money you can allocate monthly on expenses.

- Place your essential expenses, that you calculated while tracking your spending. Essential expenses are those that are crucial for your life and the lives of your relatives. These could be food, apartment, utilities, mobile service, gasoline, loan payments, parent support, medicine, or pet care.

- To create a purchase fund for big spending, summarize your expenses and subtract them from your salary.

- Now think of categories where you might need sufficient funds. It could be travel, health, shopping, gifts, education. Write them in the table.

- For each planned expense category, indicate the percentage of funds you want to allocate. Allocate between 5% and 20% for each category, and calculate the exact amount of money to save monthly for each expense. The percentage sum should not be above 100% (obvious, right?)

- Summarize total planned expenses and subtract them from the purchase fund. This is how much money is left per month for any other expenses you want. Divide by 31 to know what’s your extra daily budget.

- Now, open a subaccount for each planned category in your bank. On every salary day first of all transfer funds for planned expenses to these subaccounts.

- Now, if you want to spend money on something that falls into some of the categories, you know how much money you have, and how much money you need. Always make a purchase only if you have sufficient funds for this expense!

- If you feel that you want to save more on one category instead of another (for example, Travel instead of Shopping), adjust the percentages of these two funds by decreasing one and increasing another. Then, allocate your budget accordingly.

For example, if I want a new smartphone and it costs 400€ but I have saved for Shopping only 350€, I don’t take credit or take money from other funds. I add money from the salary to the Shopping fund and once I have 400€ I make a purchase.

4. Pay yourself first

Once you get your paycheck — you pay everyone: the government takes the tax, then the landlord wants rent (or bank a credit payment), the grocery store gets money for the food, the oil company for the gas you bought, etc. You basically make other people richer by giving your money to them. From now, start paying yourself first.

Why?

- The money saved this way will go to the emergency fund, loan repayment, and investments. This money is your future.

How?

- Open a separate subaccount in your bank and every month move 10–20% of your salary to this account.

- DO NOT SPEND THIS MONEY!

5. Build an emergency fund

As you plan your expenses and start paying yourself first, it’s time to build the most important fund. The emergency fund.

Why?

- An emergency fund is something that will give you stability and feel of safety.

- This fund will cover your ass if shit hits the fan. If you lose a job or you require emergency treatment, this is when you will be able to use it.

How?

- Calculate the average monthly spending and multiply by 5. This is the size of emergency that you must have. It will let you live for 5 months without income and not worsen your current lifestyle.

- Let’s say you spend 1800€ a month on average, then you need 9000€ in your bank account as your emergency fund.

- Since you start paying yourself, this is your first goal. Direct these 10–20% funds to the saving account until you have the needed amount.

- Don’t spend or use these funds. They are here only for extreme situations.

💡 Pro Tip! Put funds in a bank deposit or brokerage app that gives interest on uninvested funds. It will give you extra interest and save funds from inflation, meanwhile keeping them liquid.

6. Get rid of the damn debt

If you have any loans, get rid of them as soon as you have an emergency fund. Loans only suck money from you and keep you in stress.

Why?

- Getting rid of loans as soon as possible is important because it’s like lifting a heavy backpack, and once it’s gone, you’ll have more money to save and invest.

How?

- Once you have an emergency fund, start directing “pay yourself” funds additionally to the loan payments to liquidate the debt faster.

- If you have a mortgage, direct 50% of “pay yourself” funds additionally to the monthly payments, to shorter the mortgage term.

- Don’t ever take consumer loans anymore.

💡 Pro Tip! If you have a mortgage and you have enough space, consider renting out a room to pay the mortgage faster. Or, if you travel a lot, list your apartment on Airbnb while you are away.

7. Invest!

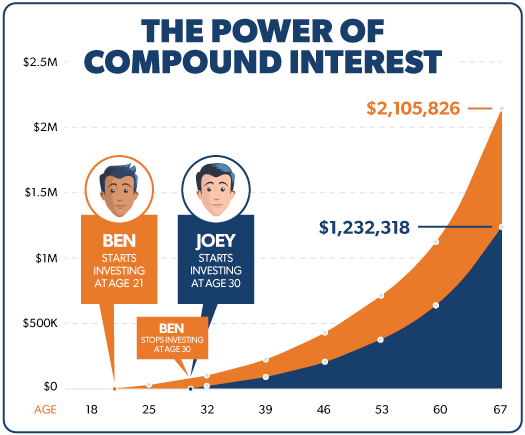

Finally, as you have an emergency fund and you got rid of consumer loans, it’s time to start investing. The sooner you start investing, the better. The magic of compound interest will work for you.

Why?

- Investing will let you grow your wealth and reach financial independence that covers your retirement.

- Though every investment is a risk, passively investing in a stock market is the most common source of reaching financial goals.

How?

How to invest is a topic that requires a tome of text, but here are some essentials:

- Open a brokerage account.

- Purchase only stocks, bonds, or ETFs (UCITS). Avoid crypto, NFT, futures, options, and other trading instruments.

- The most common funds are following the S&P500 index — IVV for U.S. or VUSA for Europe. This is a good starting point to invest.

- Invest regularly, every month.

- Reinvest any dividends you get.

💡 Pro Tip! Look at the pension fund you are using. If you are not planning a retirement in the following 10 years, switch to a stock fund instead of a bonds fund. Stocks on average more volatile, but have bigger returns.

More detailed information about investing I will uncover in the next articles.

Final Thoughts

Financial literacy is an essential life skill that can help you achieve your financial goals. By following this complete guide, you can develop the knowledge and skills needed to make informed and effective decisions about money. Remember, financial success is not about how much you earn; it’s about how much you keep and how wisely you invest it.

Summary:

- Spend less than earn.

- Plan big expenses.

- Every month “pay yourself” 10–20% of your salary.

- Have an emergency fund (5 months of monthly expenses). It’s necessary in case of disease or job loss.

- Don’t take loans. If you have them, pay them as fast as you can. Pay more than the minimum for your mortgage.

- Invest.

I hope this article was useful for you! If you enjoyed reading it, I invite you to follow me on Medium for more insightful content.

Have a good day!